Hello everyone, in this article we will talk about the Android Pay tool, which can make contactless payments. Let me remind you that the payment system began operating on May 23 and is supported by Sberbank. There are other services, of which there are more than ten. So, how do you use Android Pay to purchase goods?

What cards and phones does Android Pay support?

First, you need to understand which phones and services support the specified application. Because many people run to install it, but in the end nothing works.

Contactless payment is, of course, supported by Sberbank, so when you come across a payment terminal, you can almost always make a purchase from your smartphone. Of course, this type of payment is not yet very widespread, but everything is getting there. The list also includes the following banks: VTB24, Rosselkhozbank, Tinkoff Bank, Promsvyazbank, Otkritie, B&N Bank, Raiffeisenbank, Ak Bars Bank and others.

The program itself supports devices equipped NFC function. It won't be possible to do it without it. Concerning operating system, then the version must be at least 4.4. There have also been cases, including mine, where on a flashed phone payment system does not function. You will see a message that the firmware is not the official one. Root rights must also be turned off.

How to understand that the terminal supports contactless payment

It’s very simple, there is a special icon on the reader that says PayWave, PayPass or something similar. Also, many stores already have such devices, if you are not sure, then ask the seller, he should know.

How to link a card to Android Pay

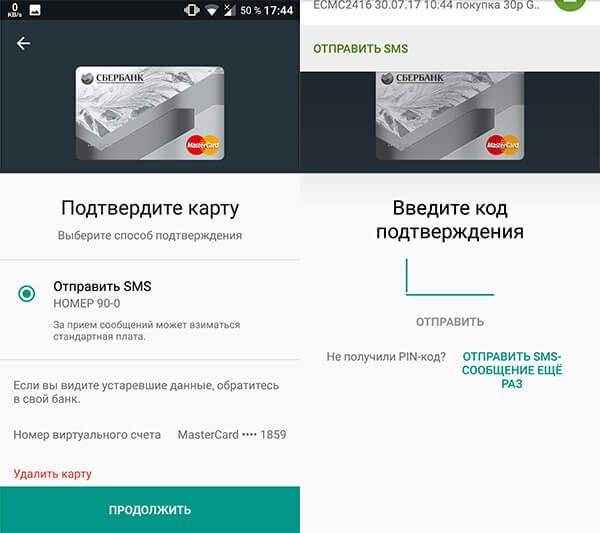

Go to the application and click on the plus sign. There will be several menu options from which you select – Add a credit or debit card. Please pay attention to other points. You can add gift cards or loyalty cards.

By selecting the first option, the next section opens. There you press " Add a map».

Using your camera, you can scan the card number (you need to bring your phone up). In this case, the card number must be convex. Or add it manually.

Unfortunately, I can’t show this with a screenshot, since the application prohibits this!

If the card type is not supported, a corresponding message will be displayed. For example, it will not be possible to add UEC cards.

There is a connection with the bank, then the card is verified and eventually a message appears about the screen being locked. That is, you are required to provide at least minimal protection, for example, a PIN code or fingerprint.

The next stage is confirmation. An SMS with a code should be sent to your phone number. Enter a six-digit number. Now you will receive a message indicating that the card has been successfully linked to the device.

Android Pay - how to use it in the store

So you linked your card, came to the store and wanted to buy something and pay using your phone. Check in advance whether it is enabled. Usually it is located in the system options in the section wireless network, or in the notifications menu.

Next, we unlock the smartphone and, if the payment terminal has the following icons, then it is enough to bring the phone close to the device, almost close. If the payment is completed successfully, you will see a corresponding notification on the screen.

Some banks may require you to enter a PIN code into the terminal. It depends on the parameters of the terminal. Usually, if you buy for more than a thousand rubles, you will need to enter a PIN code, but this is only in Russia.

In the application, it is possible to add several cards and select one as the main one. You will make transactions with it.

How to Add Gift Cards to Android Pay

In addition to credit cards, you can add gift and bonus options that provide certain discounts.

For example, I have a Read-City card that gives a small discount when buying books. I add this card to Android Pay like this:

Let's now try to scan the Tutankhamun card. We do the same procedure. Enter or scan the barcode from reverse side cards and press the button Save».

Pay by the hour

If you have a watch with the Android Wear operating system version 2.0, you can pay for purchases by installing Android Pay there. Of course, this is rarely practiced in Russia. It is also only supported Huawei devices Watch 2 or LG Watch Sport. You can also pay from other hours, provided that the system is updated to version 2.0.

Payment and adding a card is made using the same method as on a smartphone. To pay, just bring your watch to the terminal.

Is it possible to pay with Android Pay on the Internet?

Certainly. The only point here is the presence of a special function (button) in the online store, which allows you to pay for what you need in one click. There are still few services that implement this opportunity.

How safe is contactless payment using this method?

Regardless of what device you pay for or what device you take your phone to, your card numbers and data about you will not be transferred to anyone, since the devices receive a one-time key that is valid for one transaction. This code is unique for each purchase. To prevent data loss, you need to lock your phone with at least minimal protection - a PIN code, graphic key. It is desirable to have a fingerprint scanner.

In the end, we can only say one thing: no matter how you pay, there is always a small risk of losing some amount. Using cards is also not safe, and paying online is also not always safe. But you shouldn’t doze off when performing such operations.

What else can you use besides Android Pay?

There are many alternatives, for example, the long-known Samsung Pay For those who have Apple technology, there is an alternative - Apple Pay. The Meizu Pay payment system was recently released.

Now you know how to use Android Pay to pay for goods in stores where this is possible. Good luck everyone!

After yesterday’s article, readers still have several questions about the operation of the service, in this article I will try to answer them.

How to connect Android Pay?

To use Android Pay you will need a smartphone with NFC support And Android version 4.4, a card from one of the banks listed below and an installed application of the same name.

Important clarification: the service does not work if you have a root or an unlocked bootloader. Interestingly, on some Xiaomi devices with official firmware and the closed bootloader Android Pay still did not work. One of the owners also complained about the unavailability of the application. Huawei Honor 8 Pro (certified version from the online store).

Interesting fact: If you already have any cards linked to your Google account, you can immediately connect them to Android Pay. If there are no such cards, you will have to enter the card details in full. By the way, the built-in data reader incorrectly identifies the card number in half the cases, so I recommend entering it manually.

Before adding a card, make sure you have a PIN code or lock using a key or fingerprint scanner. Without this, the service will not work.

You can confirm your card either by SMS or by calling the call center.

Then we accept the terms using Android Pay together with the selected bank and set this payment method as the default.

How to pay?

If you have connected several cards, then initially the payment is made with the one that is selected by default. If you want to pay with another card, you need to open Android Pay and select it manually.

To pay for purchases up to 1000 rubles, you just need to turn on the smartphone screen and touch it to the terminal, the payment will go through automatically. To pay for a purchase for a large amount, you first need to unlock your smartphone and enter the PIN code in the terminal. I liked that for small amounts, the switched-on screen is enough; you don’t need to call up the payment window by double-clicking the button, as on iOS, and then hold your finger on the scanner for the payment to go through. iPhone owners wrote yesterday that you can touch your iPhone with the display turned off, holding your thumb on the scanner and the payment will go through, but the fact is that on older iPhones the scanner works slowly, as a result, more time is spent on payment, and sometimes you have to try twice.

You can make purchases without the Internet, but all information about purchases is stored on the network and not on the internal drive, so after several such transactions the AP will still ask you to connect to the network. And this is its disadvantage in comparison with Apple Pay and Samsung Pay.

In theory, you can also pay from your watch, but my Huawei Watch 2, despite having NFC, for some reason did not support this feature.

In addition to offline purchases, Android Pay can also be used for in-app payments. On this moment it is already available in Uber, Delivery Club, OneTwoTrip and Rambler.Checkout. Later, it should also be possible to pay on online store sites.

Safety

The main security question that has been asked many times is: what to do with the fact that you don’t need to unlock your smartphone to pay up to 1000 rubles? I read on iGuides that the maximum number of payments without unlocking the smartphone is limited to three, but I saw this mention too late, so I’ll check it myself tomorrow. But in principle, such a restriction seems logical, and if the smartphone is lost, the attacker will be able to spend no more than 3,000 rubles.

Another horror story is people on public transport walking around with terminals and surreptitiously placing them on passengers’ smartphones. In my opinion, this is also an implausible story, because it is not so easy to get a payment terminal and in case of such fraud it will not be difficult to identify the thief. Plus, for such a payment, at least the smartphone screen must be turned on, which means it is in your hand, so you will see a scammer with a terminal.

I will say this: any payment instrument, from a regular cash wallet to Android Pay, is always a small risk. In most cases, convenience justifies the mythical possibility of theft or fraud, but if you are very worried, you can either increase the limits in Internet banking or not use cards at all.

Loyalty cards

In addition to bank cards, you can also add loyalty cards to AP. The main stores are already in the service database, although it was funny with Victoria’s card, I seemed to find it in the list, entered the number, and then it turned out that if you go to the store’s website, you will not be taken to the supermarket page at all.

What do online banking purchases look like?

Advanced banking users asked to clarify whether the MCC code changes when paying via Android Pay? I answer - it doesn’t change, the transaction goes through the same way as if you paid with a card. Some banks, for example Tinkoff, place a small wireless payment icon next to such purchases so that you understand what you paid through.

Possible problems when returning

Since each purchase generates its own token, problems may arise when returning goods. If you come to return something, then you must make the return exactly through the terminal through which the purchase was made, because the token will be different for other terminals. In general, I recommend not to be lazy and for large purchases still get bank card out of your pocket, and not to show off with payment by phone.

Promotions and discounts

All promotions with Android Pay work as follows. You pay for the purchase, and then immediately part of it is returned to the card.

The most famous promotion for the launch of Android Pay is trips to the metro and MCC for one ruble. Or rather, initially they should have been for rubles, but later the conditions were changed to a 50% discount, and even later it turned out that the promotion would be valid from June 23rd.

Another promotion is a 50% discount when paying for an Aeroexpress ticket via Android Pay. It is valid only for the first 3000 participants and works great, my friend has already used it. It is important to use the linked Mastercard payment system card.

The third promotion gives a 50% discount on any sandwich at Burger King, but is also valid only for Mastercard cards.

Conclusion

Some users complained about some roughness in the operation of Android Pay, personally, I am inclined to attribute them to specific terminals and smartphones, since in my case there were no problems, the payment took place instantly.

The real problem is the location of the terminals at some points. For example, KFC in Prince Plaza keeps all the terminals near the cashiers and you have to reach for them in order to make a payment with your smartphone, and Victoria does not display an offer to pay contactless at all, although it actually works.

The date of the official launch in Russia of the payment service from Google - Android Pay happened on May 23, 2017! Owners of smartphones running the operating system of the same name are happy and, of course, wondering what devices this service works on.

The list of devices that support Android Pay is quite extensive, and this is its advantage over analogues that focus only on one brand.

Android Pay compatibility with your gadget

Your gadget will be fully compatible with only two components. This:

- Operating system Android version KitKat4 and higher. This version works successfully on models of almost any brand released after 2013. You can view the version of your operating system in “Settings” by selecting the “Device Information” sub-item. Read more about this here.

- The developer version of Android won't work either.

- The next point will be the presence on your or another Android gadget of a module that is responsible for contactless data transfer (NFC module). If you don’t know for sure whether such a function exists on, say, a phone, you can find out more information in its technical specifications. In addition, on some smartphones and tablets, the contactless data transfer function must be enabled additionally in the settings. Read about that in our article.

- You don't have to have a rooted smartphone. Also, Android Pay cannot be installed on a smartphone with an unlocked bootloader. In this way, Google strives to protect customers from scammers: devices with an unlocked bootloader are less secure. For more information, see our information. Anything is possible 😉

- Should not be installed on the phone Samsung app MyKnox.

- The device must be certified by Google.

And there are also some phones that seem to be suitable, but nevertheless you will not be able to use the payment service on them:

- Samsung Galaxy: Note III, Light, S3

- Elephone P9000

- Evo 4G LTE

- Nexus 7 (2012)

Well, that’s all, you’ll agree – a little. Today, there are about 40% of Android gadgets with the appropriate characteristics. That is, in addition to almost any smartphone or tablet of the latest generation, the service can be downloaded, for example, to a phone released in 2014. And they can do so at any retail outlet where contactless payments are accepted, and there are a great many of them today. If you want to know, go to the corresponding article.

What is Android Pay

Android Pay is an electronic payment system from Google, which is built into smartphones based on the Android operating system and allows the owner to pay for goods and services using his phone at all retail outlets where contactless payments are accepted.

Android Pay can be compared to your personal digital wallet on your phone, where you can add all your credit and debit cards, as well as discount cards from your favorite stores. Officially, the Android Pay payment system was launched in Russia on May 23, 2017, although it was introduced in 2015 and already worked in many countries, such as the USA, Great Britain, Japan, and Ireland.

For Android work Pay requires your phone (or smartwatch) to have NFC, a short-range wireless data transfer technology.

How to use Android Pay?

Paying for purchases using Android Pay is incredibly easy and convenient. You only need two steps:

- Unblock your mobile phone.

- Bring your phone to the payment terminal.

In some cases, usually with large purchases, android pay may additionally ask you to enter your card PIN code or your phone's lock PIN code.

You can use a linked bonus card (loyalty card) by opening the Android Pay application and selecting the required loyalty card - then show the barcode to the cashier. The cashier simply reads the barcode of your card. (If for some reason the cashier cannot read the barcode of your bonus card, you can simply tell him its number, it will be indicated next to it).

Already now, at the time the system opens, you can link bonus cards to Android Pay from Pyaterochka, Karusel, Detsky Mir stores, Lukoil, Gazprom gas station chains and many other retail outlets. Full list companies you can find at.

How to connect Android Pay?

To use Google's payment system, you need to download the official Android Pay app from Google Play Market and link your card (or several cards) in the application.

Make sure that the NFC payment function is enabled on your phone, go to your phone's settings and turn on the switch next to the NFC function. It is also advisable to enable the Android Beam function (its setting is located below).

2) Add a credit or debit card from a bank that supports Android Pay to the application.

To add a card, you need to take a photo of the card to recognize its number, or enter the card number yourself.

You will also need to enter the card's expiration date and its CVC code.

3) Confirm the activation of Android Pay using SMS, which will be sent to your phone number linked to the card by the bank that issued your card.

If you did everything correctly, launch the Android Pay application and you will see your card.

To add store loyalty cards, click on the plus sign in the lower right screen of the application and select - add a loyalty card, then enter the name of the store and point the camera at the barcode of your bonus card.

List of phones working with Android Pay

As we wrote above, to use Android Pay you need modern smartphone based on Android (at least version 4.4) with NFC function. (You can check if NFC is on your phone using using google or by looking at the characteristics of your phone in the Yandex market).

Please note that Android Pay, for security reasons, is not supported on devices with open root access (rooted phones).

List of popular phone models that support Android Pay:

- Samsung models S8, S8+, S7, S7 Edge, S6, S6 Edge, Note 5, S5 mini, C5, C7, A3 (2016-2017), A5 (2016-2017), A7 (2016-2017), J5

- Huawei models P8, P9, P10, Honor 8, Honor 5C, Honor 6X, Honor Note 8, Mate 8, Mate 9, Ascend P7

- Lenovo models Vibe P1, Vibe X3, Vibe Z2 Pro, K80M, A7010

- Xiaomi models Mi5, Mi5S, Mi5S Plus, Mi6, Mi Mix, Mi Note 2, Mi3, Mi2A

If you haven't found your phone model, indicate it in the comments to this article and we will definitely tell you whether it is possible to use Android Pay on your device.

List of banks working with Android Pay

As of the opening date of the payment system, 15 popular Russian banks joined Android Pay:

- MTS Bank

- Dot

- Rocketbank

- Ak Bars Bank

- Svyaz Bank

- Raiffeisenbank

- Rosselkhozbank

- Russian Standard Bank

You can find the complete current list on the official Google website - https://www.android.com/pay/#banks or by contacting your bank branch for an answer.

What is the difference between Android Pay and Samsung and Apple?

At the moment, there are 3 largest contactless payment systems in the world, these are described in this Android article Pay, as well as the Apple Pay payment system and the Samsung Pay system.

All three payment systems are very similar to each other, they use almost the same technologies, use similar security systems and payment methods.

But here it is worth noting Samsung Pay, which has one key advantage, in addition to payments using NFC, payment using electronic system from Samsung can also be made on old conventional terminals, where contactless payment is not possible. This is achieved through proprietary technology - magnetic stripe emulation (MST).

The advantages of the Android Pay system include the presence of a built-in linking of loyalty cards (bonus cards) to the application. This way, you don’t need to carry numerous bonus cards with you, just launch the application, select the required loyalty card (and often Google itself will show you the required card, according to your coordinates) and show it to the seller to read the barcode. And if the bonus card supports Balance Rewards or Coke MyRewards technology, then bonus points will be added to them automatically upon payment.

Also, unlike Apple Pay, where the contactless payment system requires a fingerprint scanner in your phone (you will need a phone no earlier than iphone models 5S), Android Pay also works on phones that are not equipped with a scanner, and security is achieved using your device’s PIN code or a set pattern password.

Android Pay and Sberbank of Russia

You can connect any Sberbank of Russia cards to the Android Pay system, except for Visa Electron and Maestro cards. Detailed information about connection and bank cards can be obtained on the official website of Sberbank.

To connect and configure a Sberbank card to Android Pay, you must also download the official Android Pay application in Google Play, link your card to it and confirm the connection of the contactless payment system via SMS. The service is absolutely free, and when paying, all the benefits and bonuses are retained, as when using a regular card. For example, you can accumulate Thanks from Sberbank by paying for goods and services using Android Pay.

Pros and cons of Android Pay

Like any modern system, the Android payment system has its pros and cons. Based on feedback from system users, we have collected the positive and negative aspects of the payment system.

Benefits of Android Pay

- Possibility to pay without a card- is the main and obvious advantage, since you do not need to carry a card with you and take it out when paying, and your phone, as a rule, is always at hand.

- The ability to link all your cards to the system and choose which one to pay with when paying. If you have a lot of cards, this is a huge plus, you get rid of a fat wallet. For example, you may have cards with cashback or bonuses in different categories.

- Now your bonus and loyalty cards are on your phone. Pyaterochka, Okay, Mvideo, Eldorado and other numerous bonus cards that you previously had to carry with you are now in your phone.

- The system works on most modern Android phones with NFC. If previously contactless payment using your phone was the domain of only Apple and Samsung, now you can buy any Android phone with NFC support and download the Android Pay app on Google Play. And even the lack of a fingerprint scanner in the phone is not a problem.

- Speed and ease of payment. All that is needed to pay is to unlock the phone with your fingerprint or PIN code and bring it to the terminal.

- Payment security. Google has taken the security of the payment system seriously, for example, when paying, it is not the card number that is used, but its virtual account, which does not allow identifying the client and copying his card data. For expensive or too frequent purchases, the system requests your card PIN code. In addition, the banks themselves guarantee protection against fraud.

- The system is completely free and retains all the benefits of your card. Connecting your card to Android Pay is free in all banks in Russia, and the bonuses that your card has, such as cashback for purchases, are saved and credited as with regular payments.

- Additional bonuses for purchases. In order to distribute and popularize the system, Google, together with banks and large retail chains, are conducting bonus promotions to attract customers to Android Pay. For example, travel on the subway for 1 ruble or a promotion from Burger King (50% on any burgers).

Disadvantages of Android Pay

- Work only with terminals that accept contactless payment. Despite the fact that most retail outlets support contactless payment, there are still a large number of small shops that use old terminals, where payment is only possible in the old way, using a magnetic stripe. This is where Samsung Pay comes to the rescue with its magnetic card emulation technology.

- There is no possibility to withdraw cash from ATMs. If you do need cash, you will have to use the card itself. At the end of June 2017, Alfa Bank, one of the first banks in the world, launched the ability to withdraw and top up cash at its ATMs using Android systems Pay, Samsung Pay and Apple Pay. Previously, the function of so-called cardless ATMs was tested by Bank of America, but this project is at the development stage.

Discounts and bonuses when paying with Android Pay

The article is being updated, stay tuned. If you have information about ongoing promotions, leave it in the comments or send it to our editor.

In the age of technology, something new appears every month. Sphere Android devices not an exception. More recently, a very interesting feature has appeared for owners of Android gadgets - Android Pay. In this article we will tell you what it is and how to use Android Pay. All information is current 05/31/19

What is Android Pay

This is a service that allows you to use your phone as a card to pay in a store. This function is especially useful in cases where you do not want to carry a lot of cards with you, are afraid of losing them, etc. And your smartphone is always with you, so why not pay with it in stores?

It’s worth noting right away that this function will be available only to those who have a smartphone or even a smart watch– NFS module. To do this, look in Google for the characteristics of your device, there you will find information about the NFS module. To use Android Pay, your gadget must have Android version 4.4 or higher. If your smartphone does not meet at least one of the above parameters, you can forget about Android Pay

In which stores can this “trick” be used?

Not all stores allow you to pay by phone. Let's say in some scary stall that is several decades old, where they still use abacus, you are unlikely to pay with your phone. After all, the terminal, like a smartphone, must also be equipped with an NFS module. Therefore, while this function with payment via phone is not very popular in the CIS countries, it is not worth leaving home to the store with only a phone in the hope of paying through it; take a card just in case. Of course, with such a feature you can stand out among your friends and other customers, but do not forget about standard payment methods, because not all stores even have terminals.

Android Pay allows you not only to pay in modern stores, coffee shops, cafes, etc., but even in some transport this function works great.

How to use this feature

- Go to Google Play, download the Android Pay application from there;

- Next, we enter your card details, or take a photo of them and the application itself will recognize all the numbers. Comfortable!

- On your smartphone, turn on the NFS module function in the curtain. If there is no icon there, go to the settings and look for this item yourself

- Done, we run to the nearest store, buy some goodies, run up to the cash register, turn on the phone and give it to the cashier.

- If you have linked several cards, select the main one from which payment will be made; if you want to pay with another card, change the main card in the settings.

Errors when paying by phone

If you touch your smartphone to the terminal and payment does not occur, the following errors may have been made:

- You forgot to unlock your phone, your phone screen must be unlocked to pay via Android Pay!

- NFS module didn't catch the signal. To do this, place the phone on the terminal with the other side, in a different position.

- You took the phone away from the terminal too quickly and did not allow the payment process to complete. To do this, you need to wait a few seconds for the payment to be made successfully.

- The terminal may not support payment through the application. In this case, you can pay either in cash or by card.

If your phone starts vibrating

- There is only one reason and it is not in your smartphone, but in the terminal. This means that for some reason the terminal did not process your request and a failure occurred.

If it says that the card is rejected, then you must contact the bank, only it will help you in this situation.

Android Pay Security

Don't worry, all your data is not stored or transferred anywhere, everything is securely protected. Keys for payment are generated randomly via Google. Mastercard Digital Enablement Service itself guarantees your safety. The main thing is, do not give your phone to others, as they will be able to pay with your phone.

Conclusion

This payment method is not yet very popular in the CIS countries, but it already works and can be used. Every day, payment via smartphone will gain momentum and everything is heading towards the fact that soon there will be no cards at all and all transactions will be carried out through your gadgets.

Of course this method has its pros and cons. Not everyone will be able to use this payment method in the store. For this you need a newer smartphone. And even if you have an NFS module, you can’t pay with it everywhere. That's all for us. Thank you for your attention!